IT modernization is more than a buzz word. Quoted from a recent Joe Williams blog, “In a non-Wall Street tone, Snowflake’s most recent quarter was a blowout: sales up 83% to $497 million, with revenue now expected to reach $1.9 billion for 2022. All from a company only founded 8 years ago. It was a much needed vibe shift for a tech industry suddenly battered after years of wild growth.”

“’We certainly hadn’t expected this degree of upside,’ Mizuho analyst Gregg Moskowitz and others, who were already bullish on the company, wrote about Snowflake’s results.”

“CEO Frank Slootman quickly got the seal of approval from investors, an audience increasingly skeptical of the prospects for the software industry. As companies like Salesforce and ServiceNow witnessed their share prices plummet after issuing muted sales forecasts for the rest of the year, Snowflake’s grew over 17% following earnings.”

“Snowflake isn’t alone. Databricks just passed $1 billion in annualized revenue and is aggressively recruiting. Earnings at Confluent and MongoDB surpassed Wall Street’s sales estimates: both of those companies provided rosy annual forecasts. Even private companies like EDB and Canva, which serve as alternatives to Oracle, Adobe and other so-called legacy companies, continue to hire, boost sales and fundraise at an impressive clip.”

“The results are a signal of the seismic shift underway in the world of business software: the arrival of the new IT stack.”

“Our space is about helping organizations transform their business, modernize their tech stack and help fund it by reducing technology debt,” said Patrick Benson, CRO for Platform 3 Solutions, when looking at the adoption of open source and cloud-based technologies like EDB. “There’s an old world-new world paradigm. We’re seeing some large companies emerge that are challenging first generation cloud vendors like Salesforce.”

Joe’s blog continues… “The divergence is stark. As Snowflake, Databricks and EDB show no signs of slowing down, Salesforce and Microsoft reduced outlooks and are implementing cost-cutting measures like hiring freezes to bolster profitability. Meanwhile, Oracle is laying off workers.”

Economic factors are certainly at play. In the face of a potential recession, some customers are forgoing investments in core applications — like HR systems or CRMs — in favor of data management and analytics. And to point out the obvious: so-called legacy vendors remain significantly larger and, as a result, are not as able to quickly adjust to wild fluctuations in the market.

But it’s a stark change from the course of the last three decades, when a handful of names — Amazon, Salesforce, Microsoft and Oracle, for example — seemed to dominate the discussion within IT departments.

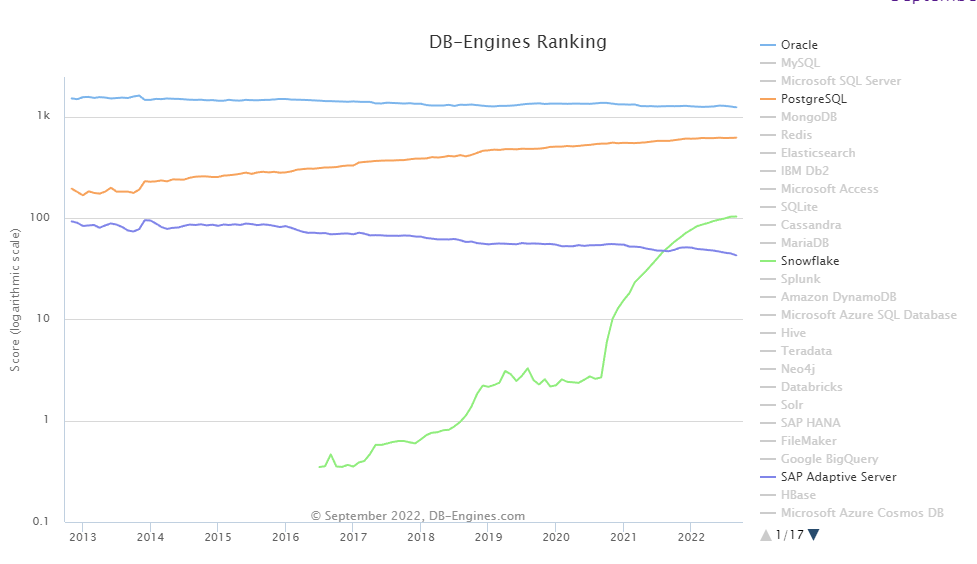

In 2005, if you wanted to buy a database, options were fairly limited. Now, the floodgates have opened. In reviewing DB-Engines, a website tracking all available data management choices, they have over 400 technologies on their ranking list.

“What Snowflake created was not an easy build by any means. If Oracle had simply recognized the looming potential of the cloud much earlier, the dynamics now could be starkly different.”

Db-Engines’ ranking over time shows the growth in open-source Postgres for transactional workloads while Snowflake for data warehousing has been a growth engine.

And while Salesforce touts its data and analytics capabilities, the foundation of the company is its core vertical applications. Salesforce “should have done this,” said Guggenheim Securities analyst John DiFucci. The company “let others get to that ‘intelligence layer’ much quicker. And it’s unclear if they’re going to be able to participate in that.”

To put it more bluntly: “Salesforce is no longer a growth name,” DiFucci added.

“For others, the current struggles are simply a result of the pivot to the cloud. It’s not uncommon for architectural shifts to bring in new market dynamics. The shift away from mainframes, for example, helped Oracle overtake IBM and solidify its former status as the world’s largest database vendor.”

“Microsoft, Salesforce, Oracle and SAP are all companies that will continue to make money hand over fist, due in no small part to huge existing install bases. Shifts in power in enterprise tech often take years, if not decades, to happen.”

The morale to the story -> as organizations move workloads to the cloud, close data centers and develop a more elastic framework they also need to get their arms around the data and build more efficiency in archiving and data mobility. Platform 3 Solutions not only understands the oldest of mainframes to the newest technologies like Salesforce, Pegasystems and SAP systems, but it also understands how to holistically address the data through the use of an ‘archive factory’ and a ‘migration factory’ model. This drives down technical and data debt.

Platform 3 Solutions is a global leader in end-to-end legacy application migration and retirement solutions. Platform 3 empowers secure and seamless transitions of data and applications, eliminates technology debt, and delivers the ROI to invest in technology modernization.